Bring your project to the world

Apply today and gain access to the benefits of a 501(c)3 organization.

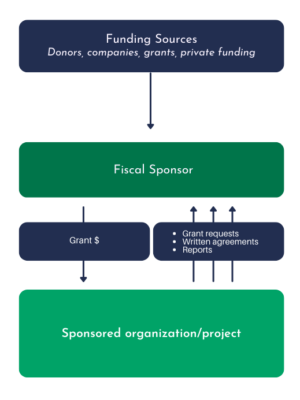

The project essentially becomes one of the Fiscal Sponsor’s programs. The Fiscal Sponsor directly receives Donations and Grants for the project or program, and the receipt and use of these funds are reported on the Fiscal Sponsor’s tax filings. The Fiscal Sponsor is responsible for the government filings, compliance tasks, fund disbursement, and financial reporting. Model A and B are similar in that the Fiscal Sponsor has fiduciary responsibility for the venture.

The charitable project or program is independent and not directly operated by the Fiscal Sponsor. The project or program functions as more of an independent contractor that operates under the Fiscal Sponsor while focusing on the mission. Donations to the project enjoy tax-deductible status and are received and disbursed by the Fiscal Sponsor as requested. Access to funding Grants are applied for under the Fiscal Sponsor. The Fiscal Sponsor is responsible for the government filings, compliance tasks, fund disbursement, and financial reporting.

The Fiscal Sponsor’s main role is to receive Grant funds and disburse them to the project or program. Fund oversight is still necessary by the Fiscal Sponsor to keep both parties protected, and within the IRS compliance standards.

Non Profit Accounting Service is working in the field of fiscal sponsorship, who recognize the value of working together to develop the field. We convene events, share peer knowledge, advocate for the field, and develop best- and next-practices together, to advance our work for the public benefit.

Fiscal sponsorship has evolved as an effective and efficient mode of starting new nonprofits, seeding social movements, and delivering public services. Fiscal sponsorship generally entails a nonprofit organization (the “fiscal sponsor”) agreeing to provide administrative services and oversight to, and assume some or all of the legal and financial responsibility for, the activities of groups or individuals engaged in work that relates to the fiscal sponsor’s mission.

Best Nonprofit Formation Services 2023 – IRS 501c3 Application Preparation – Start a 501(c) Nonprofit

To keep our administration fee as low as possible so more of the funds you raise can be used to further your charitable efforts. The fees we do collect go towards providing you project with insurance, accounting, auditing, bill paying, grant management, and other administrative services.

We work to approve your application quickly–with no hassle. That means if you apply today, you may be able to start next week!

We do not require a minimum budget and there is no need to have funding already in place.

Our administrative fees are lower than many sponsors, allowing you to spend your money where it’s needed most–on your project.

Because we want to help as many people as possible, we sponsor most projects.

Apply today and gain access to the benefits of a 501(c)3 organization.

WhatsApp us